The Liquidity Revolution: Why Tokenized Assets Outperform Traditional Investments

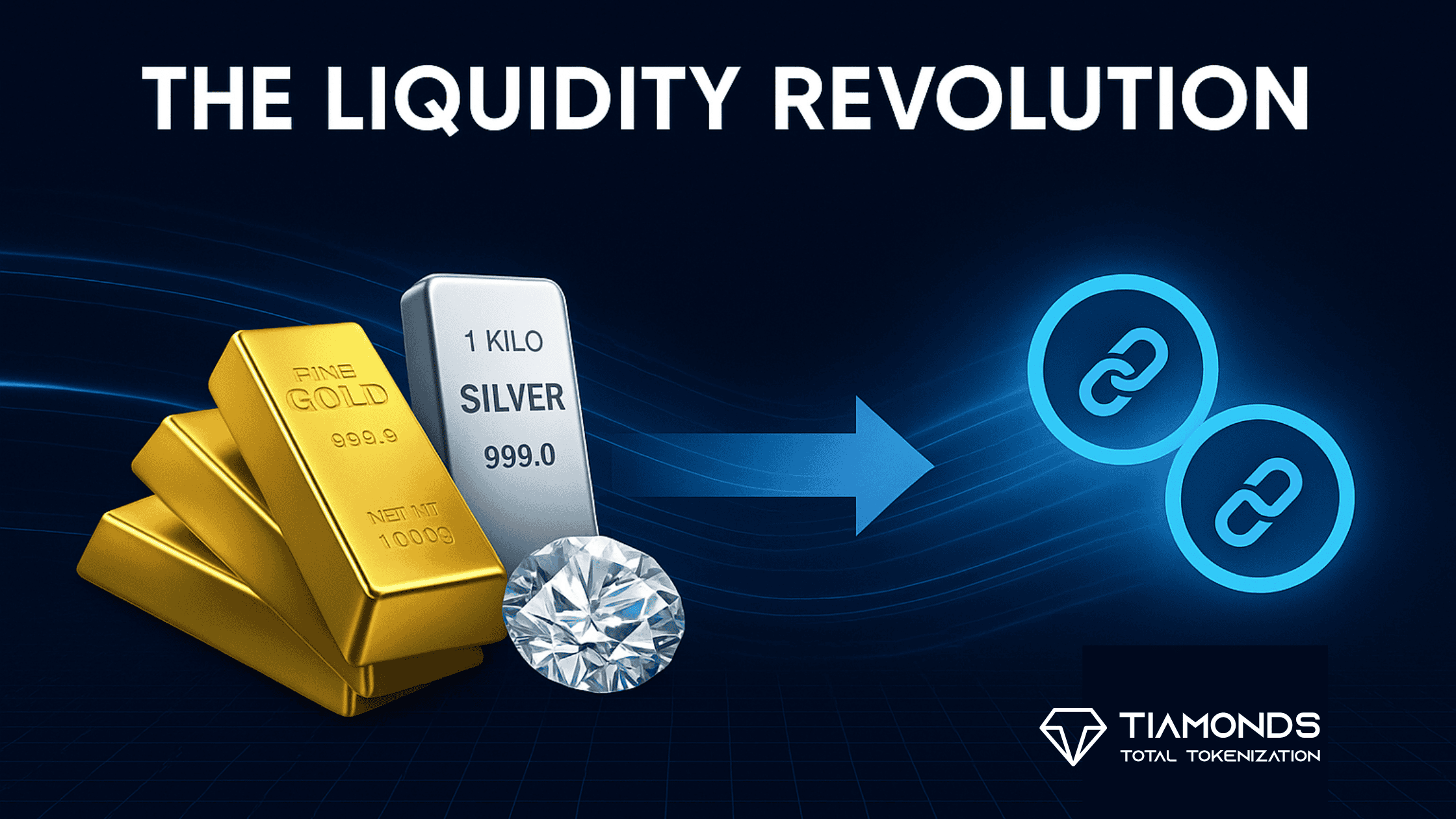

Liquidity has always been one of the biggest barriers to investing in high-value assets like diamonds, gold, silver, and sapphires. While these commodities hold enduring value, selling them traditionally is slow, costly, and geographically restricted. Tokenization changes everything. By converting physical assets into blockchain-based tokens, Tiamonds enables 24/7 global liquidity, instant settlement, and borderless transfer of ownership. This blog explores how tokenization unlocks liquidity, why it matters, and how it redefines the way investors interact with real-world assets.

Liquidity, or the lack of it, defines the value of an investment. While assets like diamonds, gold, and silver have always been symbols of wealth, they remain locked behind traditional systems that are slow, fragmented, and often inaccessible. Selling a diamond or gold bar can take weeks, involve middlemen, and incur heavy costs.

With tokenization, this bottleneck disappears. Assets move from vaults to digital wallets, and investors gain liquidity previously unimaginable in traditional markets.

Illiquidity is the silent cost of traditional investments:

For investors, illiquidity means tied-up capital, delayed exits, and lost opportunities.

Tokenization transforms illiquid assets into liquid ones by:

This creates markets that operate at the speed of digital finance, without losing the value of physical backing.

Tiamonds demonstrates liquidity in action:

Each asset is secured in insured vaults, validated by LCX under Liechtenstein’s Blockchain Act, ensuring liquidity does not compromise trust.

Liquidity is not just about buying and selling, it opens entirely new financial use cases:

This makes traditionally static assets dynamic and productive in the digital economy.

For liquidity to be trusted, it must be legal. Tiamonds operates within:

This ensures tokenized liquidity is compliant, secure, and attractive to both retail and institutional investors.

Liquidity has always defined opportunity. In traditional markets, it was reserved for the few, those with access, connections, and capital. Tokenization removes these barriers, making diamonds, gold, silver, and sapphires globally liquid, accessible, and productive.

With Tiamonds, investors no longer face the silent cost of illiquidity. Instead, they gain access to 24/7, borderless, compliant markets for the assets that have defined wealth for centuries.

Tokenization is not just digitization, it’s a liquidity revolution.