On-Chain vs Off-Chain Asset Tokenization

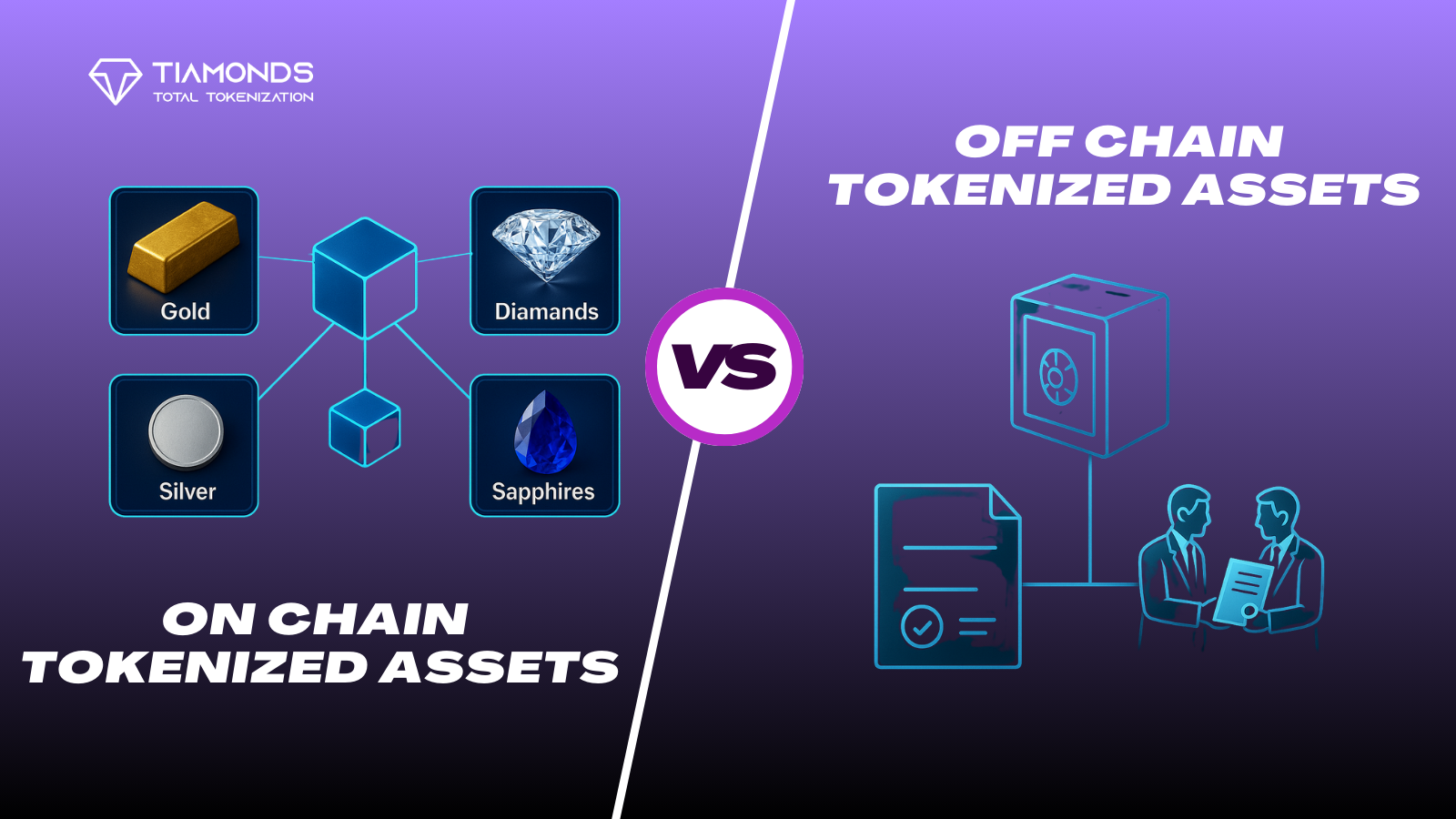

Tokenization is redefining asset ownership and transferability in the digital world. At Tiamonds, this innovation is at the core of what we do, which is tokenizing real-world luxury assets such as diamonds, gold, silver, and sapphires. However, not all tokenization is created equal. There are two prominent models: on-chain and off-chain asset tokenization. Each comes with its distinct advantages and challenges.

This blog compares the two approaches to help users, investors, and enthusiasts understand which model best supports trust, transparency, and long-term value. With Tiamonds adopting a unique on-chain asset tokenization model without fractional ownership, the distinction is particularly important for our ecosystem.

Key Highlights

Asset tokenization is the process of converting ownership rights of a physical or digital asset into a digital token on a blockchain. This token acts as a representation of the asset and can be traded, stored, or transferred in a secure and efficient manner. At Tiamonds, we focus on tokenizing high-value assets like diamonds, gold, silver, and sapphires — each backed one-to-one with a real-world physical asset. However, how these assets are recorded and managed on the blockchain determines the system’s transparency, security, and trust.

On-chain asset tokenization involves recording all relevant asset data directly on the blockchain. The token and its attributes exist and function entirely through smart contracts and decentralized protocols, providing complete transparency.

Tiamonds uses on-chain tokenization to create a one-to-one mapping of each luxury asset to an NFT, stored immutably on the blockchain. Every diamond, gold, silver, or sapphire token on Tiamonds has verified physical backing and can be audited on-chain. This system ensures transparency, verifiability, and seamless transfer of ownership without any middlemen.

All physical assets are authenticated and verified by LCX, Tiamonds’ licensed physical validator, ensuring each token is backed by a real-world item with legal enforceability.

Off-chain asset tokenization refers to creating tokens on a blockchain that represent assets whose actual data, verification, or custodianship exists outside the blockchain. The blockchain holds a reference or pointer, but not the asset details themselves.

Off-chain tokenization is often used in traditional financial systems, real estate, or for highly regulated assets, where on-chain automation isn’t fully compliant yet. These models may work well for institutions but lack the transparency and autonomy that blockchain promises.

Both on-chain and off-chain asset tokenization approaches offer valid advantages depending on the application. However, on-chain tokenization emerges as the superior option for projects aiming for full transparency, security, and decentralization, especially in the luxury asset space.

Tiamonds has tokenized diamonds, gold, silver, and sapphires entirely on-chain to ensure that users hold real, traceable, and unshared ownership of tangible assets. This model aligns with the Web3 ethos and provides long-term confidence to collectors and investors alike.

As blockchain technology evolves, the debate between on-chain and off-chain asset tokenization will remain central to how real-world assets are digitized and distributed. At Tiamonds, we have committed to building a transparent and secure tokenization ecosystem powered by on-chain integrity. Whether you are a first-time collector or a seasoned investor, understanding the differences between these models empowers you to make informed decisions in the world of tokenized assets.